News Center

Electric vehicles (EVs) are the focus of global environmental policy implementation. More and more automakers are recognizing that the future is no longer about the internal combustion engine (ICE) ecosystem. As a result, they are adjusting their business models to prepare for the future.

The most critical component of electric vehicles is the battery, so the competition between global automakers and battery manufacturers is increasingly fierce, and they are competing for supremacy in the electric vehicle battery market. But competition also helps to achieve technological breakthroughs.

Lithium-ion battery technology is at the heart of automotive innovation and has made great strides. Here, we briefly introduce some of the achievements and the future direction.

NCM 811 is just around the corner

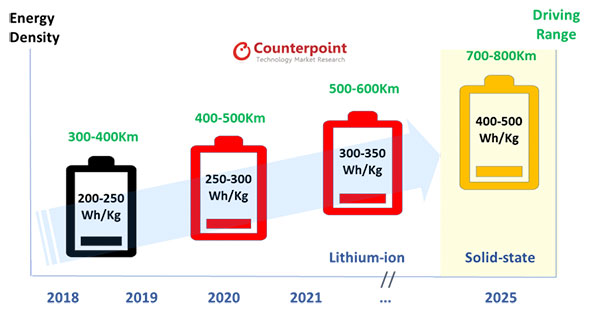

Battery manufacturers are investing heavily in research and development to improve the energy density of lithium-ion batteries. Although progress has been slow, lithium-ion batteries have improved the range of electric vehicles by utilizing high-energy raw materials and improving the size of single batteries. Manufacturers have been trying to increase the proportion of nickel in the anode material. Most of the top battery manufacturers have announced plans to commercialize/mass-produce NCM811 in 2019-2020. With 80 percent nickel, 10 percent cobalt and 10 percent manganese, the NCM811 has a longer service life and allows electric vehicles to go farther on a single charge.

In April, CATL announced the start of mass production of the NCM811. Recently, AESC, which Vision Group acquired from Nissan, also announced plans to produce the NCM811 and promised a weight energy density of more than 300 watt-hours/kg and a volume energy density of more than 600-650 watt-hours/l by 2020.

Solid-state batteries are not far behind

Battery manufacturers have been looking to solid-state battery technology as the next generation of technology and have demonstrated several innovative products. In theory, solid-state batteries replace the liquid electrolyte in lithium-ion batteries with a solid electrolyte made of polymer or ceramic materials, which can reduce the risk of electrolyte exposure or explosion caused by physical impact. Solid electrolytes perform well at high temperatures and high volumes, further increasing energy density. Automakers are actively developing solid-state batteries. So far, Toyota ranks first in the number of solid-state battery patent applications. Last year, Volkswagen announced it would invest $100 million in solid-state battery maker QuantumScape to mass-produce solid-state batteries by 2025.

[Battery energy density and electric vehicle range are improving]

Battery price cut

Lower battery and pack prices are also driving the adoption of electric vehicles. At the end of 2018, the price of electric vehicle batteries and battery packs was estimated at $140-150 per KWH and $170-180 per KWH, respectively. As energy density increases and battery manufacturers achieve economies of scale, the price per KWH will continue to fall. We expect EV battery and pack prices to fall below $80 per KWH and $100 per KWH, respectively, by 2025, representing a cost reduction of around 10% per year. Currently, battery packs account for 30-40% of the manufacturing cost of electric vehicles, but after 2025 electric vehicles will be cheaper than equivalent internal combustion engine (ICE) vehicles. As more and more countries phase out internal combustion engine vehicles and automakers deploy electric vehicles, battery price reductions will cause the market to explode in demand for electric vehicles. Eventually, this will create a virtuous cycle.

The market size has jumped

Counterpoint Research's smart vehicle research shows that there will be more than 11 million electric sedans (including pure electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs)) in 2025, and there are many opportunities across the new value chain. After 2025, the price of electric vehicles is expected to be the same as traditional internal combustion engine cars, or even lower, bringing new business opportunities for automakers and battery manufacturers. Not only is the electric vehicle market growing, but so is the sales-weighted average battery capacity of electric vehicles. As a result, we expect the electric vehicle (BEV/PHEV) battery pack market to exceed 60 GWH by 2025 and bring in nearly $60 billion in revenue.

Capacity expansion

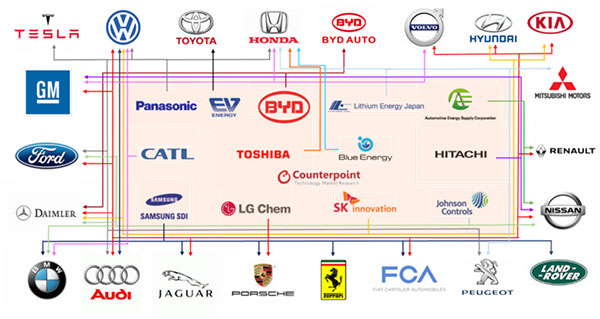

Leading battery manufacturers such as CATL, Panasonic, LG Chem, Samsung SDI and SK Innovation are competing for orders from global automakers, vigorously promoting each other's development. We see no point in battery suppliers lining up to grab orders, as long-term orders are typically flexible in terms of volume and price and are dependent on market conditions. Instead, it is necessary for battery manufacturers to understand the expansion plans of the entire industry to track future changes in supply and demand. Production capacity has been expanding rapidly since global sales of electric vehicles surged. At the end of 2018, cumulative production capacity reached 129 GWH. We expect cumulative battery capacity for electric vehicles to increase to nearly 775 GWH in 2025, driven by the expansion of leading players.

The competitive landscape will not change significantly until 2025

Unlike other technology products, batteries are custom components. From the product development stage, batteries are precisely optimized for each electric vehicle for optimal power and safety management. As the EV battery business requires long-term competitiveness in product development as well as experience in mass production, the industry has high barriers to entry. This is why we expect the existing leaders to continue to lead the market and the competitive landscape will not change significantly in the near term.

But what about automakers willing to take battery technology and production into their own hands? In the early stages, we think they will have to work with multiple battery suppliers for a long time. Long-term contracts can help automakers solve supply bottlenecks when market demand soars and secure the promise of better prices. Automakers also have flexibility in the event of an emergency and encourage suppliers to compete with each other to get better prices. At the same time, they will try to produce electric vehicle batteries in-house through acquisition of know-how and research and development or exclusive cooperation with battery suppliers. After 2025, when the market focus shifts from the current lithium-ion batteries to solid-state batteries, the entire industry will change.

[Global electric vehicle battery suppliers and automakers]

(Source: 199IT)

Return to Overview